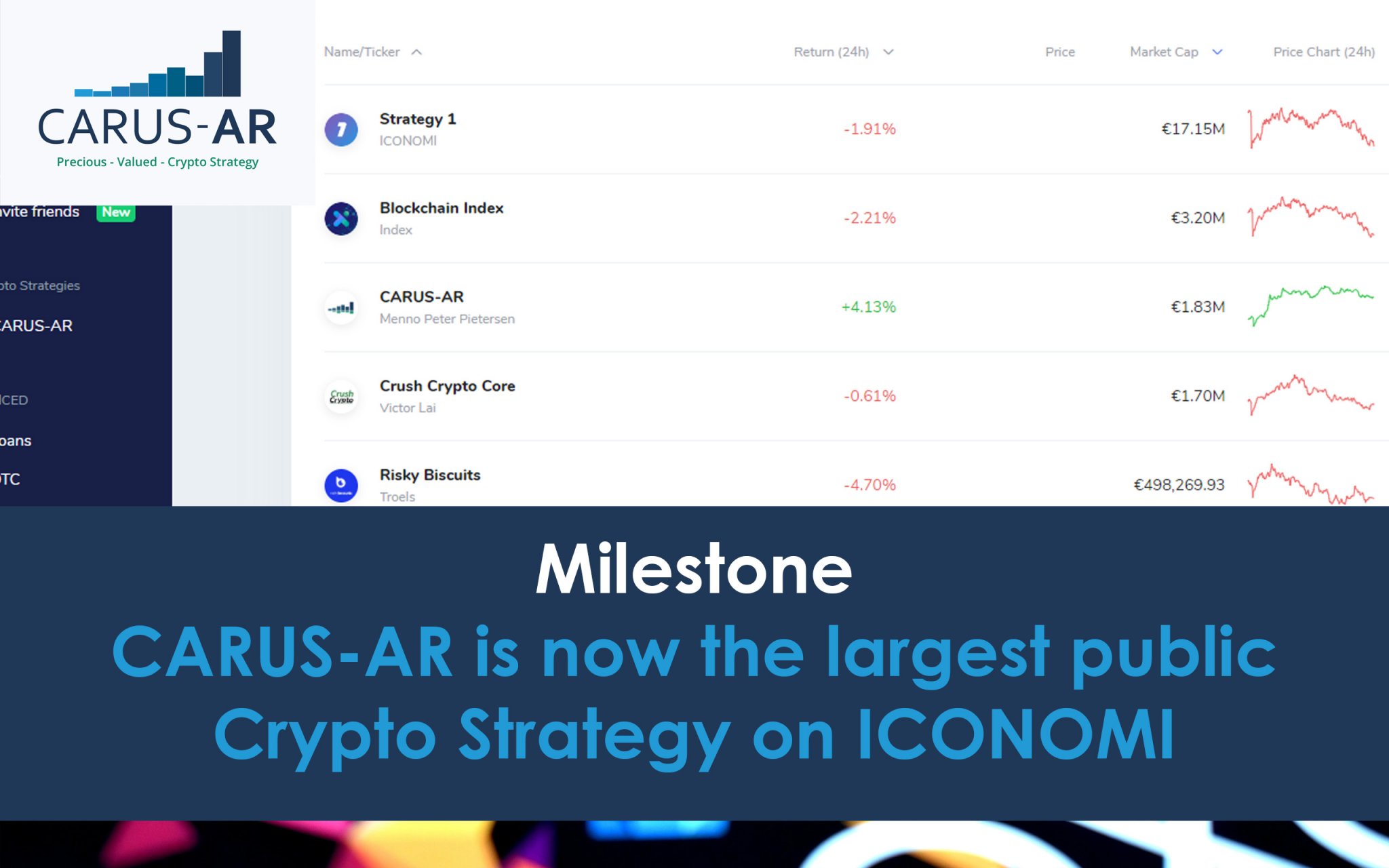

CARUS-AR is now the largest public Crypto Strategy on ICONOMI

Published on: 11 August 2020

Yesterday CARUS-AR became the LARGEST ICONOMI crypto strategy with over 1.8 million € following the CARUS-AR strategy.

The content below is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice.*

What an amazing milestone!

Cheers to all my crypto friends, investors and most of all the ICONOMI team

I am amazed at the growth, support and gains I have had the past months, after holding on during the Bitcoin, crypto Ethereum bear market the reward is beyond sweet.

The trend has turned bullish

Ethereum has clearly outperformed Bitcoin the past year, but even better CARUS-AR has outperformed Ethereum by a huge margin!

This trend and quickly accelerating bullmarket for ALTS (especially DeFi and dPoS projects) can be clearly seen in this price compare chart of the past year for some of our main holdings

How high will the bull take us?

Nobody can be sure the bullmarket will be as crazy as in 2017, or if it will get even crazier...

The main focus of the CARUS-AR strategy is to stay diversified and take profits when we can, as explained in our blog post about profit taking, we will be slowly adding to our USD position when times are bullish. Our current TUSD position is 3%.

The CARUS-AR profit taking strategy

For CARUS-AR we choose to use strategy Sell a fixed % every week when in profit, but we take a more active approach to this. Since we actively watch the markets and trends, we choose to select the profit taking moments ourselves and not do this simply weekly.

Now that we see the crypto markets are truly bullish, CARUS-AR will:

- increase our FIAT holdings (TUSD) in steps by 0.5%

- adjust the frequency of these profit taking steps depending om market trends and sentiment (active management)

- use the FIAT TUSD position to buy the dips (BTFD) when larger corrections happen

Using this strategy we combine the positive aspect of continious profit taking with active management.

We hope to contine to outperform both Bitcoin (BTC) and Ethereum (ETH).

Will do all I can to have a balanced, diversified and profitable strategy, let's take profits on the way UP!